tax loss harvesting wash sale

The remaining 4200 loss that is disallowed under the wash sale rule would be added to your cost of the 300 shares. Selling now will trigger the wash sale rule as you will still hold 100 shares of the stock.

Crypto Taxes Usa 2022 Update What You Should Know

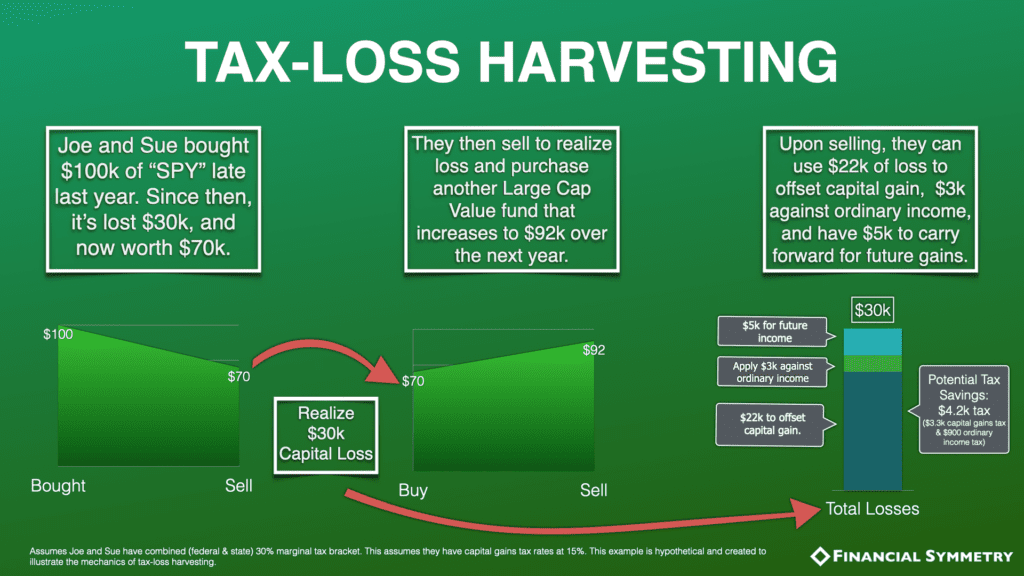

The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their.

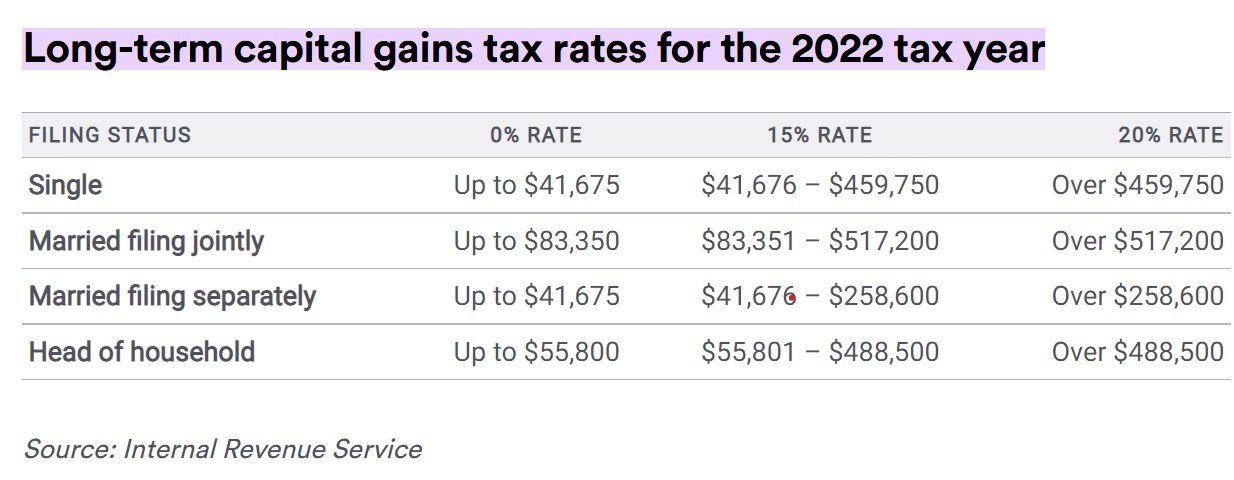

. Started using it in July 1st and here are the statistics. That being said the end of the year is a great time to use a tax planning strategy called tax-loss harvesting. The top rate for long-term capital gains 20.

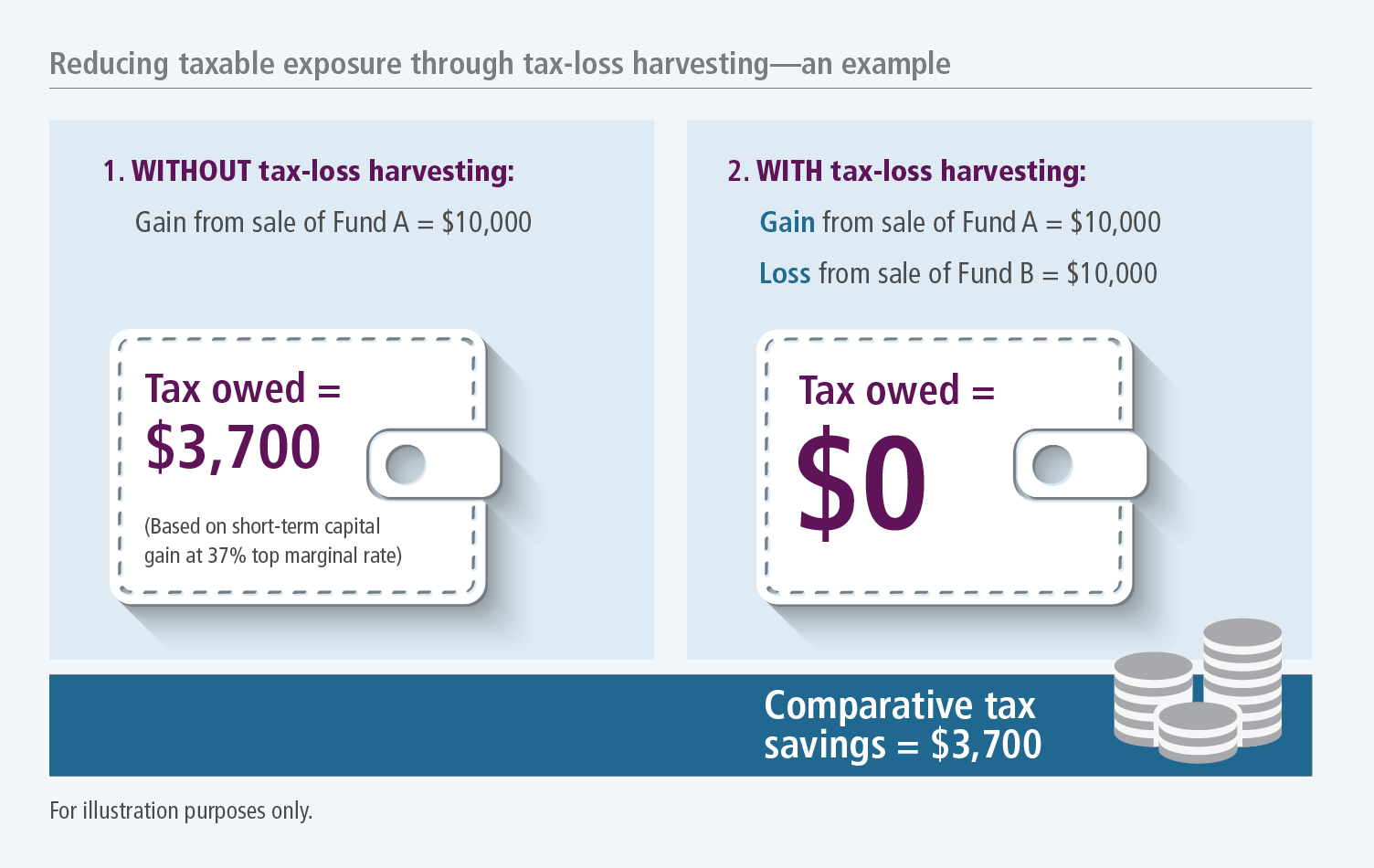

When you use tax-loss harvesting you can use realized. Wash sale rule considerations Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US. Once losses exceed gains.

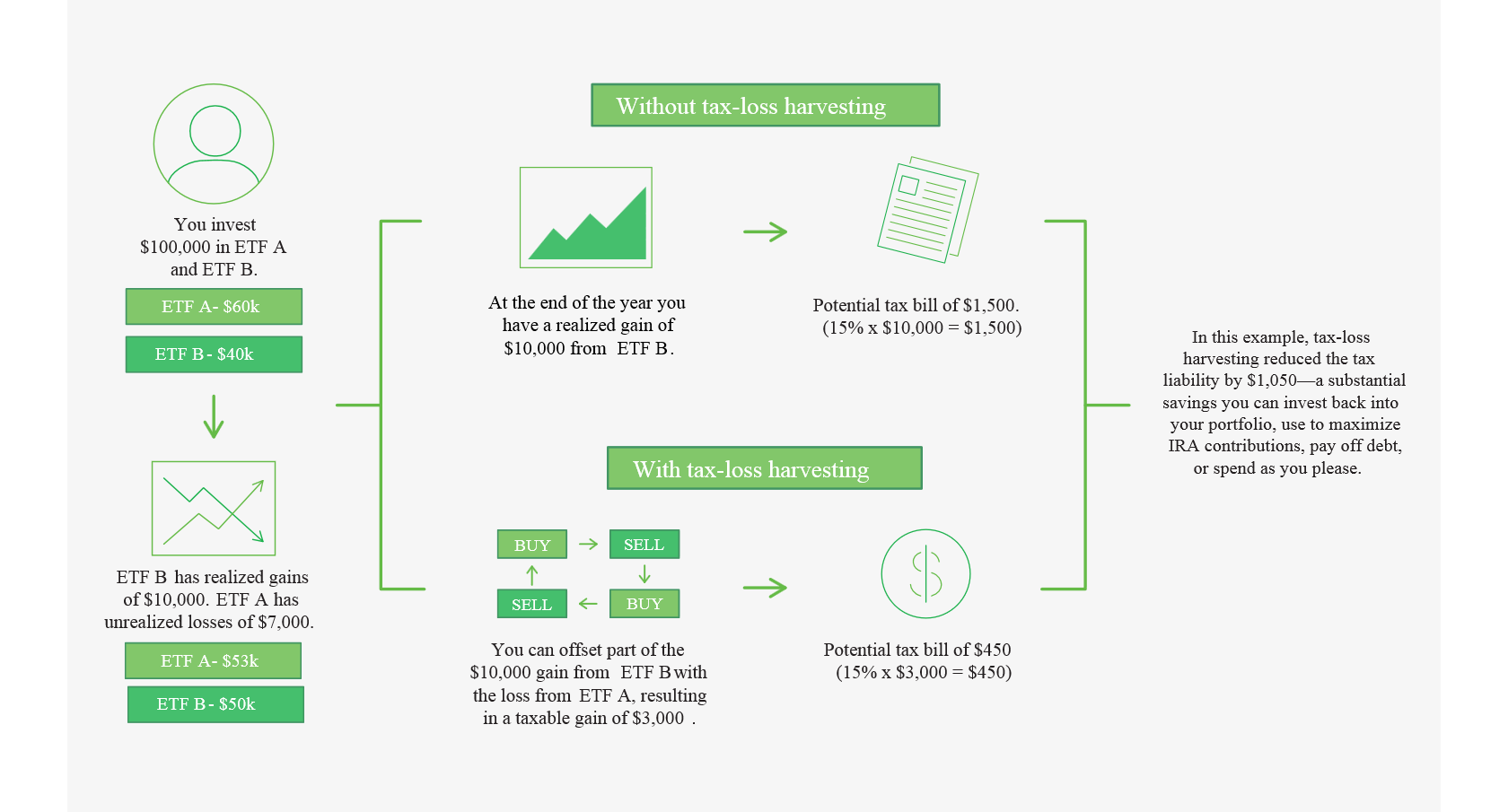

The good news is that losses may come with a silver lining in the form of potential tax benefits. This strategy involves selling investments such as stocks exchange. Higher income earners can currently pay up to a 238 tax rate on realized long-term capital gains.

I built an algo using theta strategies selling OTM puts and calls on SPY about 90 of trades with occasional far OTM IV crush plays. Tax loss harvesting is a strategy for reducing taxes today by selling funds at a loss. To claim a loss for tax purposes.

The Medicare surtax for high-income. To do it you simply need to lock in a loss by selling the. For the 2020 tax year federal tax rates on items potentially pertinent to harvesting include.

While its the easiest method. Existing strategy Problem. The strategy known as tax-loss harvesting allows you to sell declining assets from your brokerage account and use the losses to reduce other profits.

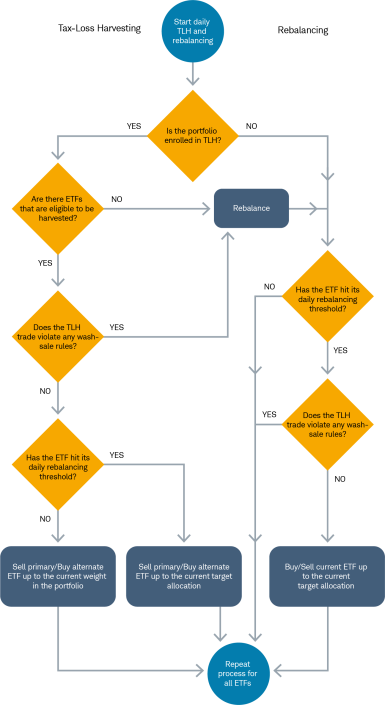

Wash sale rule considerations Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US. RadagastTheWhite 1 day ago. Otherwise you need to wait 30 days to buy again to avoid Wash Sale.

The Definitive Guide to Tax-loss Harvesting and Avoiding Wash Sales. Tax-loss harvesting as it is known allows investors to offset gains realized in one investment. Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end.

Link to download all my Portfolio Trackers. If youve been fortunate to realize some big capital gains. The wash sale rule is avoided because December 22 is more than 30 days after November 21.

Delay reinvesting the proceeds of a harvest for 30 days thereby ensuring that the repurchase will not trigger a wash sale. Offset realized capital gains. You can achieve the same goal with a less expensive alternative approach.

Tax Loss Harvesting With Vanguard A Step By Step Guide The Physician Philosopher

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade

Wash Sale Rule What Is It Examples And Penalties

Us Tax Law And Cryptocurrency Part 2 Tax Loss Harvesting And Wash Sales R Cryptocurrency

Tax Loss Harvesting Year End 2018 John Hancock Investment Mgmt

Tax Loss Harvesting And Wash Sales Marotta On Money

Planning To Tax Loss Harvest Beware Of The Wash Sale Tax

Tax Loss Harvesting Real Example Of A Wash Sale And Irrelevant Wash Sale Bogleheads Org

Tax Loss Harvesting A Silver Lining In Bear Markets Financial Symmetry Inc

Tax Loss Harvesting With Fidelity A Step By Step Guide Physician On Fire

United States Why Does My Brokerage Show Adjusted Due To Previous Wash Sale Disallowed Loss When I Sold My Entire Position Personal Finance Money Stack Exchange

Make Sure Your Future Gains Aren T Lost In The Wash Marcum Llp Accountants And Advisors

Rebalancing And Tax Loss Harvesting In Schwab Intelligent Portfolios Charles Schwab

.png)

The Complete Guide To Crypto Tax Loss Harvesting

Tax Loss Harvesting 2022 John Hancock Investment Mgmt